[ad_1]

The chief executives of ExxonMobil Corp and Chevron Corp held preliminary talks in early 2020 to explore combining the two largest United States-based oil producers in what would have been the biggest merger of all time, according to media reports.

The discussions, which are no longer active, are indicative of the pressure the energy sector’s most dominant companies faced as the COVID-19 pandemic took hold and crude prices plunged.

The talks between Exxon Chief Executive Darren Woods and Chevron CEO Mike Wirth were serious enough for legal documents involving certain aspects of the merger discussions to be drafted, one of the sources told the Reuters news agency. The reason the talks ended could not be learned, Reuters reported.

But the Wall Street Journal newspaper, citing its own unidentified sources, reported that the discussions could be revived in the future.

Michael Wirth, chairman and chief executive officer of Chevron Corp (left), and Darren Woods, chairman and chief executive of Exxon Mobil Corp (right) [File: Andrew Harrer/Bloomberg]

Michael Wirth, chairman and chief executive officer of Chevron Corp (left), and Darren Woods, chairman and chief executive of Exxon Mobil Corp (right) [File: Andrew Harrer/Bloomberg]

The Reuters sources requested anonymity because the matter is confidential. Exxon and Chevron, which have market capitalisations of $190bn and $164bn, respectively, declined to comment, Reuters said.

Exxon and Chevron’s shares nosedived last year after a Saudi-Russian price war and fallout from the novel coronavirus outbreak caused the value of oil to crater. Exxon’s stock was hit hardest, as investors raised concerns about the company’s long-term profitability and spending decisions.

In their talks, the CEOs of Exxon and Chevron envisioned achieving synergies through significant cost cuts to help weather the downturn in energy markets, one of the sources told Reuters. At the end of 2019, Exxon employed about 75,000 people and Chevron roughly 48,000.

Following the aborted talks with Exxon, Chevron went on to acquire oil producer Noble Energy in a $5bn cash-and-stock deal that was completed in October.

Regulatory scrutiny

A proposed combination last year would almost certainly have triggered an intense antitrust review by the US Department of Justice, a process that typically takes months to complete. And such a review would also potentially have run up against last November’s US presidential election, raising additional uncertainty about how soon such a deal might be cleared, if at all.

Now, under the Biden administration, the window might be all but closed as Democrats historically have been less sympathetic to such deals, one of the sources said. President Joe Biden has put climate change at the forefront of his agenda, promoting jobs in renewable energy as opposed to traditional ones in the oil sector.

Biden recently formally revoked the permit to build the Keystone XL oil pipeline. General Motors last week said it would aim to stop selling vehicles powered by gasoline and diesel, which rely on oil, by 2035.

The White House and Justice Department did not immediately respond to requests by Reuters for comment.

News of the unsuccessful talks emerged as Exxon has come under pressure from some of its shareholders over its strategic direction.

Engine No. 1, an investment firm based in San Francisco, last week nominated four directors to Exxon’s board and is pushing the company to spend its cash better, preserve its dividend, and invest more in clean energy. Exxon is also in the crosshairs of hedge fund DE Shaw, which is pressuring the company to cut costs and improve performance.

Exxon reports fourth-quarter results on February 2. Chevron last week reported a surprise $11m fourth-quarter loss as low margins on fuel, acquisition costs and foreign currency effects overwhelmed improved drilling results.

Potential giant

A combined Exxon-Chevron would be eclipsed in size only by Saudi Aramco, which boasts a roughly $1.8 trillion market value and has previously pushed many US drillers to the financial brink by flooding the market with oil.

It also could be the largest corporate tie-up ever, depending on its structure. That distinction now belongs to the roughly $181bn purchase of German conglomerate Mannesmann AG by Vodafone AirTouch PLC in 2000, according to research firm Dealogic.

Such a deal would reunite the two largest descendants of John D Rockefeller’s Standard Oil monopoly, which was broken up by US regulators in 1911 and reshape the oil industry.

Despite inevitable antitrust concerns, Exxon and Chevron could argue that a merger would represent the US’s best shot at taking on the Saudi state-owned conglomerate and the world’s other largest state-backed oil producers, one of the sources told Reuters.

Last year’s Saudi-Russian oil price war, for instance, highlighted the vulnerability of US producers to foreign governments that can effectively dictate the price of crude by forcing energy companies they back to boost or cut output.

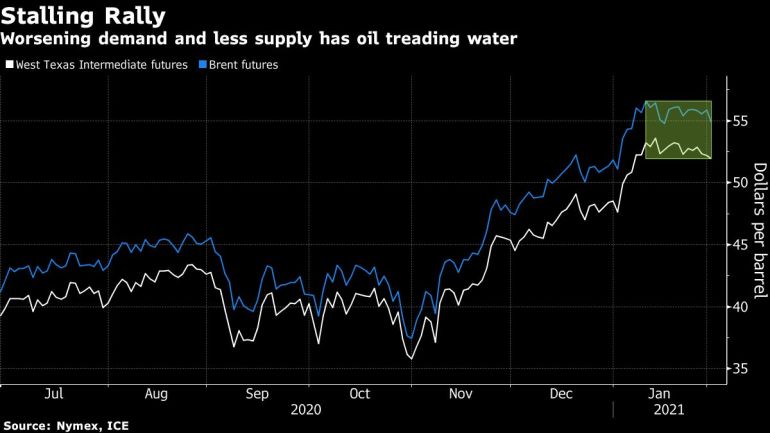

[Bloomberg]

[Bloomberg]

US oil companies each compete among one another and set their own varying production targets, with Washington having only a limited ability to intervene.

Exxon and Chevron, with their powerful balance sheets, withstood turmoil in energy markets following the pandemic that forced some smaller independent oil and gas producers to file for bankruptcy protection.

Yet they also felt the pain. Demand for oil evaporated in early 2020 as governments imposed travel restrictions and stay-at-home orders to slow the COVID-19 pandemic’s spread.

At one point in April, the price of US West Texas Intermediate crude futures turned negative for the first time ever, signifying sellers needed to pay buyers to take the commodity off their hands. Prices have since rebounded to roughly $52 a barrel.

Exxon and Chevron have cut jobs over the past year. Exxon late last year left its dividend flat after boosting the shareholder payout each year since 1982.

In an interview with the Wall Street Journal discussing Chevron’s earnings last Friday, Wirth, who – like Exxon’s Woods – also serves as his company’s board chairman, said that consolidation could make the industry more efficient. He was speaking generally and not about a possible Exxon-Chevron merger.

“As for larger-scale things, it’s happened before,” Wirth told the newspaper, referring to the 1990s and early-2000s mega-mergers. “Time will tell.”

[ad_2]

Source link